Thursday, December 28, 2006

Feeling Nosy about DC? MD? VA?

Feeling nosy about the District of Columbia?

Feeling nosy about Virginia?

Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

Thursday, December 21, 2006

Feeling Nosy about DC? MD? VA?

Ok, I know you're probably not planning on moving this very second, but here's this week's list of interesting-looking listings that have just come on the market. Mind you, they may not actually be my personal listings --- just intriguing properties I've come across that week.

Feeling nosy about the District of Columbia?

Feeling nosy about Virginia?

Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

Thursday, December 14, 2006

Feeling Nosy about DC? MD? VA?

Ok, I know you're probably not planning on moving this very second, but here's this week's list of interesting-looking listings that have just come on the market. Mind you, they may not actually be my personal listings --- just intriguing properties I've come across that week.

Feeling nosy about the District of Columbia?

Feeling nosy about Virginia?

Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

Thursday, December 07, 2006

Feeling Nosy about DC? MD? VA?

Feeling nosy about the District of Columbia?

Feeling nosy about Virginia?

Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

Thursday, November 30, 2006

Feeling Nosy about DC? MD? VA?

Feeling nosy about the District of Columbia?

Feeling nosy about Virginia?

Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

Wednesday, November 22, 2006

Feeling Nosy about DC? MD? VA?

Feeling nosy about the District of Columbia?

Feeling nosy about Virginia?

Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

An open letter to sellers …

Today’s home buyers

The buyers who are out there today are a completely different breed of buyer than you were. If you bought your home in the last four or five years, you were a real risk taker. You flew from open house to open house, possibly with an offer in your hand. You waived home inspections, appraisals, financing contingencies. You wrote offers well above the asking price, with ginormous earnest money deposits. You ignored all advice from fathers-in-law and office mates. You knew what you had to do and you did it. You leapt before you looked, and you accepted the consequences.

You made the real estate market fun!

You desperately wanted to get into the market, and you stopped at nothing to make that dream a reality. And you were amply rewarded for your chutzpah. You got a house (at a time when it was close to impossible), and you got to take advantage of that tide of appreciation that raised all boats. In all likelihood, your home is worth much more today than you paid for it.

Now, if you can only get a buyer to make an offer!

What you should understand is that buyers today are much more risk averse and circumspect than you were. Being risk averse and circumspect were not options for you. If you wanted to buy a home, you had to throw caution to the wind. Today’s buyers don’t have to, and they’re not going to, and you can’t make them. Nyah.

Today’s buyers are all those folks who didn’t have the stomach for your market. They wanted to wait until that market cooled down. They refused to play the reindeer games. They would not be bullied by sellers into making ridiculous offers. They created and pored over Excel spreadsheets that told them that those rapidly inflating prices were totally unsustainable. They hemmed and hawed, and waited. While you were painting your new powder room, glad to be out of the frenetic pace of buying, they fretted about their quality of life and worried being “house poor.” They commiserated with each other about the market, and they sought advice from all and sundry. Luckily for you, you just sat back and watched your investment grow. You showed them.

Well, now, all those risk-averse buyers are back. And they’re mad. And they’ve got muscle. And they’re using it. On you.

Buyers today have a couple of very notable options that were unavailable to you --- choice and time. There is incredible inventory out there today, which means that buyers can be choosy. And they can take their time doing it. They may see a hundred homes before making an offer. They may go back to homes they sorta kinda like, two or three times, or more. They may sit with their agent and write an offer … and then take the evening to “sleep on it.” And then NOT PRESENT THAT OFFER AT ALL because they want to see more properties.

All of this would be anathema to you. You would just do it. Pull the trigger already. Buy a house, for crying out loud, you’d scream at them.

Negotiations

When a buyer actually does write an offer on your property, first of all, you must consider yourself lucky. It will seem very hard to do. Please understand, though, that if you receive an offer, you’re way ahead of 90% of the other sellers out there that month. The offer will seem unbelievably low. Just prepare yourself now. Your knee-jerk response will be to tell the buyer’s agent to kiss your foot. Resist the urge. Please. Forget that the buyer’s agent set off your burglar alarm and then didn't lock the door behind herself. Forget that you overheard the buyer insulting your grandmother's antique dining table. Forget that the buyer’s agent called just as you were putting your fussy baby down for a nap and HAD TO SHOW YOUR HOUSE RIGHT THEN. Remember, you’re lucky to even have an offer. Keep repeating that. I’m lucky. I’m lucky. I’m luuuuucccckkkky.

A buyer who writes an offer on your home has probably seen many, many other homes. He or she knows that there are many other options out there --- possibly hundreds. That there are so many options WILL be factored into the buyer’s offer to purchase your home. And the offer may seem quite low. Resist the urge to reject such an offer. Remember how long it took to get it. Even the lowest offer should be rejected only after very careful thought. If the offer isn’t to your liking, hold your nose and make a counter offer.

Home inspections

So, you’ve gotten an offer (disgustingly low as it was), you’ve negotiated with a recalcitrant buyer and his idiot agent for the last 10 days, and you’re now officially UNDER CONTRACT. Whew. Thank goodness that’s over! But don’t start spending your money so fast. You’re only in the eye of the hurricane. The winds will start whipping in the other direction soon … you’ve still got to get through the home inspection.

The buyer’s offer will probably be contingent on a satisfactory home inspection. It’s also quite possible that you never had a home inspection when you purchased it. If there are any niggling issues that you know of, address them now, before going on the market if possible. Nearly every home inspection reveals something the seller was unaware of. If what has been revealed is something that you would fix if you were going to continue living in the home (a cracked hot water heater, a roof leak, etc.), you should probably agree to fix it, whether it would be required under the contract or not. If it’s a safety or habitability issue, address it. This is not the time to flat-out refuse to do something that a buyer asks for, no matter how ridiculous it sounds to you. Now is the time to negotiate around these issues. Steel yourself now.

A note about disclosure. If your home inspection reveals defects that you didn’t know about and you are not able to come to terms with the buyer, you may be required to disclose those defects to other prospective buyers. (Check with your agent or a local real estate attorney.) Such disclosure may (ok, probably will) dampen enthusiasm for your home, thereby reducing your home’s market value. You’re probably better off trying to come to terms with the buyer, as hard as it may be to swallow in the moment.

Appraisals

As the market continues to adjust, we are seeing more and more appraisal issues cropping up. So, even though you’ve agreed to sell the property for a price below what you’d hoped, and you’ve agreed to shell out money to fix the loose toilet seat after the home inspection, and you’ve agreed to give the buyer money to help pay for her closing costs --- now the appraiser says the house is worth LESS than you’ve agreed to accept. Aaargh.

The good news

There’s a sense among some analysts that the market is shifting, for the better. "We've probably seen the worst of the housing slump, although it may not have entirely bottomed out yet," says Freddie Mac chief economist Frank Nothaft. "Lower mortgage rates should help stimulate activity in the housing market."

With the mid-term elections over, the free-floating anxiety about the political scene has dissipated, which has kept some buyers out of the market. Plus, there will be a new crop of politicians and staff members moving into the area. While some of them will initially rent, many will enter our housing market as buyers. More buyers looking at the same inventory may also create additional urgency in the market.

All of which is good.

Thursday, November 16, 2006

Feeling Nosy about DC? MD? VA?

- Feeling nosy about the District of Columbia?

- Feeling nosy about Virginia?

- Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

Thursday, November 09, 2006

Feeling Nosy about DC? MD? VA?

Feeling nosy about the District of Columbia?

Feeling nosy about Virginia?

Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

Monday, November 06, 2006

The importance of staging ...

During Friday’s Washington Post Real Estate Live discussion with Maryann Haggerty, the topic of staging came up and the content is great, and exactly what we are always telling our sellers:

"Alexandria, Va.: Maryann, love your column. Having recently sold my home within three weeks (we received multiple offers in early October) I have some advice for sellers: Get rid of the clutter. We rented a $99 a month storage unit and rid our home of all the clutter. Make sure your home is clean and fresh looking. We put fresh flowers out. Make sure the house shows well. Spend that extra money on paint and carpet if necessary. We updated light fixtures and added crown molding ourselves. You have to price your house accordingly. We had our realtor pull comps every week and we reduced our price one time (we had two offers several days later)."

"Maryann Haggerty: Yes, a house that sells now is one that sparkles. And it's truly amazing how we become blind to the small faults and the clutter in houses we live in every day."

This is not 2000 to 2005, when people were buying houses with no inspections and were willing to overlook all the little things. Think about it. Do you even notice, say, the grubby kid fingerprints on your own front door? But wouldn't those be the FIRST thing you noticed at an open house?

When you get ready to place your home on the market for sale, it becomes a product. Similar to a product on the shelf at your local store, the product has features and benefits, as well as pluses and minuses ... and competition. To compete with the competition in the marketplace you must be priced right and look better than the other products. Your home is no different, it is one of many homes for sale and you must present it, to the buyers, in the best possible light. Staging is the process of preparing any home for sale, regardless of price or location, and it works. Staged homes sell faster and for more money than other homes in the market.

Thursday, November 02, 2006

Feeling Nosy about DC? VA? MD?

We know you have QUESTIONS about real estate!

Thursday, October 26, 2006

Feeling Nosy about DC? VA? MD?

RealAstute.com Home Team's Michael Dillon quoted in Washington Post

Thursday, October 19, 2006

Feeling Nosy about DC? VA? MD?

Positive Price Changes in DC

by Mary Jo Powell, Metropolitan Regional Information Systems

With the exception of Alexandria and Arlington, Virginia, sold prices in and immediately surrounding Washington, DC were up for the month of September, according to figures released today by Metropolitan Regional Information Systems, Inc. (MRIS).

“Sold prices rose a substantial 10.76% over September of 2005 in DC,” said Economist John McClain, of George Mason University. “That, coupled with gains in the areas close-in might signify that the market is still strong for neighborhoods that don’t involve a lengthy commute, given today’s rising gasoline prices and traffic congestion.”

And McClain points to hopeful signs in outlying Loudoun County, as well. “Even though the average sold price is down over September of 2005 in Loudon, it’s markedly better than the 14.22% drop experienced in August of ’06.”

McClain says he anticipates that a closer look at the figures will show that the condo market is primarily responsible for driving prices down, due to speculators’ unloading, and that townhouses and single family homes are still holding their own.

Average Selling Prices for September 2006 ---

Winners

- Washington, DC: $564,200 (UP 10.76% from September 2005)

- Prince George’s County, MD: $342,664 (UP 6.47% from September 2005)

- Montgomery County, MD: $517,823 (UP 1.52% from September 2005

Losers

- Frederick County, MD: $368,894 (DOWN 4.30% from September 2005)

- Alexandria, VA: $476,551 (DOWN 5.03% from September 2005)

- Fairfax County, VA: $514,124 (DOWN 6.01% from September 2005)

- Loudoun, VA: $514,068 (DOWN 4.79% from September 2005)

- Fauquier County, VA: $405,716 (DOWN 33.95 % from September 2005)

- Warren, VA: $255,798 (DOWN 6.69% from September 2005)

Thursday, October 12, 2006

Feeling Nosy about DC? VA? MD?

Thursday, October 05, 2006

Feeling Nosy about DC? VA? MD?

Thursday, September 28, 2006

Feeling Nosy about DC? VA? MD?

Thursday, September 21, 2006

Feeling Nosy about DC? VA? MD?

Thursday, September 14, 2006

Feeling Nosy about DC? VA? MD?

Thursday, September 07, 2006

Feeling Nosy about DC? VA? MD?

Thursday, August 31, 2006

Feeling Nosy about DC? VA? MD?

Thursday, August 24, 2006

Feeling Nosy About DC? VA? MD?

Thursday, August 17, 2006

Feeling Nosy about DC? VA? MD?

Thursday, August 10, 2006

Feeling Nosy About DC? VA? MD?

Wednesday, August 09, 2006

DC Transfer & Recordation Rates to Rise on October 1, 2006

On October 1, 2006, the DC Recordation Tax and the DC Transfer Tax rates will be increasing from 1.1% of the sales price to 1.45% of sales price for transactions with purchase prices of $400,000 and above. (Buyers pay the Recordation Tax and sellers pay the Transfer Tax.)

As a precaution, title companies are advising sellers and buyers with late-September settlements to consider moving those settlements to earlier in the month. (The transaction has to be "on record" with the District no later than October 1st to avoid the higher tax; recordations sometimes takes a few days beyond settlement). Example: A settlement that would occur on Friday, Sept 29th would not be on record with the District until the following week and thus be subject to the higher recordation tax.

After October 1st, the recordation tax on a $500,000 purchase, for example, will be $7,250 --- or, $1,750 HIGHER than under the old rate.

Thursday, August 03, 2006

Feeling Nosy about DC? VA? MD?

Thursday, July 27, 2006

Feeling Nosy About DC? VA? MD?

Thursday, July 20, 2006

Feeling Nosy About DC? VA? MD?

Thursday, July 13, 2006

Feeling Nosy About DC? VA? MD?

Thursday, July 06, 2006

Feeling Nosy About DC? VA? MD?

Thursday, June 29, 2006

Feeling Nosy About DC? VA? MD?

Thursday, June 22, 2006

Feeling Nosy About DC? VA? MD?

Thursday, June 15, 2006

Feeling Nosy About DC? VA? MD?

Thursday, June 08, 2006

Feeling Nosy About DC? VA? MD?

Friday, June 02, 2006

Capitol Hill Real Estate Tour of Homes

Capitol Hill Real Estate Tour of Homes

This Sunday, June 4th at Noon

Curious? Nosy? Buyer? Seller? Not Sure?

Please Join the RealAstute.com Home Team

As we visit 5 homes

priced between $350,000 to $500,000

currently on the Market

on Capitol Hill

Meet at Noon at Long and Foster Capitol Hill Office

721 D Street, NE

At the Eastern Market METRO Station

To RSVP or for more information please contact:

Michael Dillon, REALTOR

Licensed in DC, VA

202-369-9821 or Michael@RealAstute.com

Michael F. Dillon, Jr.

Realtor

Long & Foster, Realtors - Capitol Hill Office

721 D Street, SE

Washington, DC 20003

michael@realastute.com

Cell: 202-369-9821

Office: 202-547-9200

Fax: 202-478-5194

Please visit my website at:

www.RealAstute.com

Thursday, June 01, 2006

Feeling Nosy About DC? VA? MD?

Thursday, May 25, 2006

Feeling Nosy About DC? VA? MD?

Thursday, May 18, 2006

Feeling Nosy about DC? VA? MD?

Thursday, May 11, 2006

Feeling Nosy about DC? VA? MD?

Monday, May 08, 2006

Don't Let Water Damage Drain Your Wallet

There are preventative measures you can take to reduce the chance of water damage in your home from a faulty appliance. They involve the following:

- An average water heater lasts about 10 years. If you notice wet spots on the floor or rust forming on the tank it is a good idea to think about replacing it.

- A worn out rubber or plastic hose is an accident waiting to happen. Examine the hoses on your appliances and under sinks for leaks from water lines or drain pipes. Consider replacing them with stainless steel hoses which have a much longer lifespan.

- If your air conditioning unit is located in the attic check it periodically and have it maintained by a professional. Make sure that your service agreement includes inspecting and cleaning the unit annually. A leak starting in the attic will do considerable damage.

- Only run dishwashers and washing machines while you are home. If the appliance should malfunction you can turn the water off in order to avoid a huge flood. It is, of course, vital that you know where the main water shut off valve is located in your home.

- For less than the cost of dinner you can purchase a water alarm. They work much the same way as smoke alarms do and are simple to install. They can be placed on the floor or wall mounted.

- The alarm's sensor will trigger if exposed to any level of moisture.

Thursday, May 04, 2006

Feeling Nosy about DC? VA? MD?

Thursday, April 27, 2006

Feeling Nosy about DC? VA? MD?

Friday, April 21, 2006

Household Hazardous Waste and Electronics Recycling Collection THIS WEEKEND

Carter Barron Amphitheatre parking lot

16th & Colorado Avenue, NW, Washington, D.C.

Earth Day, Saturday, April 22, 9:00 am - 3:00 pm

Residents can drop off end-of-life consumer electronics, including audio-visual equipment, televisions, cell phones and home office equipment such as computers, computer parts, photocopiers and fax machines. These machines will be broken down into their component parts (plastic, glass, toxic metals) and recycled or disposed of safely.

For more information, visit the DPW website...

FAQ's about Household Hazardous Waste

Mortgage news ... what's happening

Mortgage bond prices fell last week applying upward pressure to interest rates. Rates were under pressure all week as trading conditions were thin ahead of the extended holiday weekend. Investor fears of inflation tied to economic growth and continually high oil prices pressured mortgage bonds. In addition, there was speculation that improved economic conditions abroad could lead to a reversal of the foreign flight to quality buying that helped interest rates remain low over the past years. For the week, interest rates on government and conventional loans rose about 5/8 of a discount point.

Consumer price index data and the Fed minutes will be the most important events this week. Producer price index, housing starts, leading economic indicators, and the Philadelphia Fed survey will also be important.

Consumer Price Index

The Consumer Price Index is widely accepted as the most important measure of inflation. The CPI is a measure of prices at the consumer level for a fixed basket of goods and services. The National Statistics Office and the Bureau of Agricultural Statistics of the Department of Agriculture collect price data for the computation of the CPI. Since it is an index number, it compares the level of prices to a base period. By comparing the level of the index at two different points in time, analysts can determine how much prices have risen in that period. Unlike other measures of inflation, which only factor domestically produced goods; the CPI takes into account imported goods as well. This is important due to the ever-increasing reliance of the US economy upon imported goods. Analysts primarily focus on the core rate of the CPI which factors out the more volatile food and energy prices.

High oil prices continue to weigh heavily upon the financial markets. The health of the economy remains uncertain. Stocks continue to bounce up and down.

Market participants expect the consumer price index to set the tone for bond market trading the last portion of this week. Inflation friendly data may lead to improvements in mortgage interest rates. However, unexpected consumer price spikes may push interest rates higher in the short-term. With the uncertainty surrounding the release now is a great time to take advantage of mortgage interest rates at their current levels.

Connie Echeverria

Loan Officer

Prosperity Mortgage Company

Thursday, April 20, 2006

Feeling Nosy about DC? VA? MD?

Thursday, April 13, 2006

Feeling Nosy about DC? VA? MD?

- Feeling nosy about the District of Columbia?

- Feeling nosy about Virginia?

- Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

Monday, April 10, 2006

Mortgage rate update

For the week, interest rates on government and conventional loans rose about 1/2 of a discount point.

Connie Echeverria

Loan Officer

Prosperity Mortgage Company

HUD proposal allows FHA to offer risk-based premiums

Thursday, April 06, 2006

Bankrate's forecast for the changing real estate market

They talked to experts, studied public and private databases, analyzed market trends and examined the analyses of many others. The results are follow.

The ten "bubble blowers," where appreciation should continue to grow:

- Boise (ID)

- El Paso (TX)

- Albuquerque (NM)

- Seattle (WA)/Portland (OR)

- Salt Lake City (UT)

- Raleigh (NC)

- Philadelphia (PA)

- Atlanta (GA)

- Little Rock (AR)

- Cincinnati (OH)/Birmingham (AL) (they were too close to call)

The ten "bubble sitters," where appreciation may have peaked:

- WASHINGTON (DC)

- Ft. Myers/Cape Coral (FL)

- Chicago (IL)

- Honolulu (HI)

- Tucson (AZ)

- San Francisco (CA)

- Detroit (MI)

- Minneapolis (MN)

- Baltimore (MD)

- Denver (CO)

The ten "bubble busters," where values are expected to decline:

- Las Vegas (NV)

- Sacramento (CA)

- Phoenix (AZ)

- Boston (MA)

- Los Angeles (CA)

- Naples (FL)

- Miami/Ft. Lauderdale (FL)

- Edison (NJ)

- Newark (NJ)

- Nassau/Suffolk (NY)

You'll probably notice that Washington, D.C., tops the "Bubble Sitters" list, indicating that prices may have topped out for a while. So while other markets will continue to experience robust appreciation and others will decline, Bankrate.com appears to think that the DC market may stabilize somewhat from the hyper-inflation we've experienced over the last few years.

OK. Well. This is what many of us in the DC market have been saying for a while — though this position was not as sexy as all the sky-is-falling articles in the Washington Post and and hysterical Fox News reports. Seems we're poised for what forecasters are calling a "soft landing."

Whew.

That said, there's plenty of evidence to suggest that not *all* is well with the DC real estate market. Seems that there's a rapidly increasing inventory of condo units on the market. If you're looking to buy one of those sexy new condos where the developer is offering all sorts of groovy percs (closing cost assistance, REALTOR bonuses, free plasma screen TVs, free wireless Internet), you may want to tread carefully. If you're going to hold onto this potential unit for 5-8-10 years, you'll probably be in good shape. If you're in a job position where you have the potential of being transferred, or if you'll otherwise be in DC for a limited time — hey, DC can be a transient sort of place — think twice. Renting isn't awful. Or, you might consider a single-family home or townhome in a less sexy location.

Feeling Nosy about DC? VA? MD?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!

Saturday, April 01, 2006

Mortgage update for the week

A Focus on Employment

The Fed is most concerned with keeping a tight lid on inflation. Interest rate market analysts pay close attention to a multitude of measures of economic activity under the assumption that when economic activity increases to certain levels, inflationary pressures become imminent.

March employment data will be released on Friday morning. The employment data provides very important information about whether the economy is overheating to the point that inflationary pressures may increase. The logic is that as economic activity continues to grow and fewer people are left unemployed, employers have a tendency to bid up employee wages. The employment report provides an abundance of information for almost every sector of the economy. Not only does the employment report give basic employment payroll statistics for the major working sectors, it also provides the average hourly earnings and the average workweek. Using this information provided by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor, economists estimate many other economic indicators such as industrial production, personal income, housing starts, and GNP monthly revisions. Since there is little data for economists to base their estimates on, the margin of error for the estimates tends to be high. As a result, the employment report can cause substantial market movements. The BLS compiles data from two unrelated surveys that they conduct, the household survey and the establishment survey, in order to complete the employment report. This explains why sometimes there is an unexpected divergence between the unemployment rate and payrolls figures each month.

This week’s employment data will provide valuable insight into factors the Federal Open Market Committee will use to make future rate decisions. Employment strength may prompt the Fed to continue to raise short-term interest rates. However, if employment begins to weaken, the Fed may take a break from the continued rate hikes and mortgage interest rates may get a much-needed reprieve.

Connie Echeverria

Loan Officer

Prosperity Mortgage Company

M4049-011

4400 Jenifer St., NW

Washington, DC 20015

202.364.1300 x6061 Office

202.285.3937 Mobile

202.966.4632 Confidential Fax

866.359.7205 Confidential eFax

connie.echeverria@wellsfargo.com

Thursday, March 30, 2006

Picking the Right Time to Buy

The truth is that the proper time to buy is ANY time when your “DNA” is right.

That’s regardless of what the experts say, particularly the harbingers of impending turndowns or stagnations. (Many doom-shouters predict four or more major market slumps for every one that actually comes to pass.).

Those last three words, incidentally, are significant ones, because all market changes literally come to pass; they never come to stay indefinitely. If you haven’t lived through these phenomena in the past, just ask someone who has.

Given the fact that real estate historically “goes up” in the long run, even those buyers who find that they’ve overpaid for a home need only wait for the price tide to rise in order to refloat their economic boat. Meanwhile, chances are good that the “bottom fisherman” who held off in anticipation of an elusive bargain almost certainly missed opportunities to own a desirable home and may later have to settle for something less and/or pay even more.

About that DNA reference: It is one of those acronyms (home-made in this case) that are so popular these days, but it’s in no way related to the crime show plots so prevalent on the TV screen. Rather, it points to three elements that, when they are present, not only suggest that a home purchase is appropriate, but mandate immediate action – notwithstanding negative news from the pundits:

- The “D” stands for desire --- what you and your family really want in terms of lifestyle. A home is more than just an acquisition of land and building materials. It’s also more than just where your family lives. It is HOW you live as well. This sets homes apart from other forms of investment, wherein the price paid may be a paramount consideration. The “desire to acquire” a new lifestyle must be a major force in the purchasing procedure, and if it is present, it should be given the highest priority. Failing to do so will invite later regrets, which are much harder to live with than, perhaps, slightly elevated mortgage payments.

- “N” means that the home must satisfy practical needs --- such as space, safety, community services, schools and creature comforts, including a reasonable degree of luxury. Don’t discount pride of ownership in this category! Human nature being what it is, when the desire is strong enough, needs will be either manufactured, rationalized or both, but the practical side should always be recognized.

- “A” stands for an ability to pay for the subject property. Regardless of how passionately a home is desired or how badly needed, unless the price and terms are manageable, the transaction is simply not doable. That said, and getting back to an earlier comment, when the home is wanted with sufficient level of intensity, the budget will be s-t-r-e-t-c-h-e-d to the absolute limit. (A cautionary note: The “A” factor should be explored in depth before the actual house-hunting begins; do this to avoid the pain of satisfying both desire and need, only to find that the dream is beyond reach.)

Those who are persuaded by the pundits to “wait an see what happens” are in imminent danger of joining the forlorn (and crowded) ranks of those who now observe present prices with dismay, ruefully commenting, “why, I remember when I could have bought those places for (whatever $), or even less!” (Ah, but they DIDN’T --- and there’s the point!)

If you find yourself on the fence, be mindful of a genuine American pundit (and poet) names John Greenleaf Whittier, who wrote: “Of all sad words of tongue or pen, the saddest are these: “it might have been.”

Thinking about a change? Check out your “DNA,” then go for it!

Feeling Nosy about DC? VA? MD?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!)

Saturday, March 25, 2006

Mortgage rate update

- Mortgage bond prices fell last week pushing interest rates higher. Traders remained concerned about possible future Fed rate hikes in response to the expanding economy and inflationary pressures. However, the weaker than expected new home sales data Friday helped alleviate some of those fears and helped mortgage bonds recover a portion of the losses seen earlier in the week.

- For the week, interest rates on government and conventional loans rose about 1/8 of a discount point.

- The 2-day Fed meeting Monday and Tuesday will be the most important event this week. Foreign demand for the Treasury auctions, income, outlays, consumer sentiment, and factory orders data will also be important.

- The United States central bank, the Federal Reserve, coordinates the borrowing and lending activities of federally chartered banks. The principal reason the Federal Reserve was created was to reduce severe financial crises. One way of accomplishing this goal is to control the amount of money that flows through the economy. By manipulating the US money supply, the Fed influences inflation, unemployment, and the level of US economic activity. The Fed has a variety of tools that it uses to control the money supply, but its chief policy tool is the manipulation of short-term interest rates.

- The Federal Reserve can adjust two distinct short-term interest rates. The discount rate is the interest rate which banks pay the Fed for primarily overnight loans. Despite its name, the Fed funds rate is the rate banks pay to borrow from other banks. The Federal Reserve has direct control over the level of short-term interest rates, the Fed’s influence over longer-term interest rates is less certain.

- The Fed is expected to raise rates again this week. Rates have gradually pushed higher over the past few months.

Now is a great time to take advantage of rates at the current levels and to protect against future rate increases.

Connie Echeverria, Loan Officer

Prosperity Mortgage Company

M4049-011

4400 Jenifer St., NW

Washington, DC 20015

202.364.1300 x6061 Office

202.285.3937 Mobile

202.966.4632 Confidential Fax

866.359.7205 Confidential eFax

connie.echeverria@wellsfargo.com

Thursday, March 23, 2006

Feeling Nosy about DC? VA? MD?

Ok, I know you're probably not planning on moving this very second, but here's this week's list of interesting-looking listings that have just come on the market. Mind you, they may not actually be my personal listings --- just intriguing properties I've come across that week.

- Feeling nosy about the District of Columbia?

- Feeling nosy about Virginia?

- Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!)

Thursday, March 16, 2006

Feeling Nosy about DC? VA? MD?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!)

Wednesday, March 15, 2006

What's the deal with 13 SEER?

A nationwide Federal mandate recently changed the current Seasonal Energy Efficiency Rating (SEER) from 10 to 13 effective January 23, 2006.

Huh? What does that mean?

Well, SEER measures the minimum energy efficiency level for central air-conditioning systems --- similar to the miles-per-gallon rating for cars. The more energy efficient the air conditioning equipment, the higher the SEER rating. This legislative change is intended to result in a 30% increase in energy efficiency for air conditioners and heat pumps, hopefully resulting in cleaner air and environment.

OK. So what.

After January 23, 2006, U.S. manufacturers may only produce air conditioners and heat pumps units with a minimum 13 SEER rating. Units that are less than 13 SEER can still be installed ... that is, until inventories have been depleted.

Some pertinent details for consumers:

- 13 SEER units will be LARGER and MORE EXPENSIVE. Consumer costs will be HIGHER for modifications, changes, upgrades, and labor.

- Current parts (i.e. the condenser) may be INCOMPATIBLE with 13 SEER units, therefore requiring the entire unit be UPGRADED.

- Coils are 3-4 inches taller. This may REQUIRE ADDITIONAL SPACE such as enlarging the current area or even moving the unit to a different area of the home.

- Condenser units are larger and may require larger concrete pads or roof stacks.

- 40% MORE FREON is required to operate a 13 SEER unit. Current freon lines may be too small and may have to be upgraded.

What this all means for real estate agents?

- Real estate agents should prepare their sellers and buyers by encouraging them to have their existing units checked prior to heating season and air conditioning season.

- Even during the winter months a licensed HVAC technician can determine the condition of the unit; promote this inspection in addition to a regular home inspection.

- If the unit is "borderline", or can not be checked adequately, consider suggesting that buyers escrow funds for possible replacement of unit.

- The value of coverage for your clients becomes more evident! Strongly encourage putting a home warranty policy on the home to help defray the increased costs associated with the 13 SEER mandate.

- It is imperative to note that --- as is standard in the industry --- most modification work due to code non-compliance or changes in equipment size that is necessary as a result of the new standards will continue to be at the home owner's expense.

Additional information can be found at the Department of Energy's website.

2006 Real Estate Forecast

Experts have differing opinions regarding the 2006 Real Estate Environment. While some see a significant slow down in the market due to rising interest rates and other market conditions, others, such as David Lereah, the National Association of Realtors chief economist, suggest that, "the slow down amounts to a tapping of the brakes on a hot market," and that conditions will remain favorable for housing, albeit not at the torrid pace of the last couple of years.

Freddie Mac is predicting that fixed-rate mortgages and i-year adjustable rate mortgages will average around 6.5% and 5.5% respectively in 2006. While housing starts and total home sales are expected to decline somewhat compared to the past year, both will be at a very healthy pace again in 2006, but at a more normal and balanced rate than in the previous few years. Hopefully, Sellers will adjust their expectations for double digit increases in value, thus encouraging Buyers to continue to purchase at a historically high pace.

With the continuing aging of the Baby Boom Generation, it is expected that the purchase of second homes and retirement homes will continue to be strong. While some experts have expressed concern about possible decrease in property values in some of the hotter markets such as Las Vegas, Miami and many California cities; others, such as those at Merrill Lynch, feel that most of those markets will, in fact, not experience price or volume declines due to factors such as migration, limits on supply and job growth. The Washington, D.C. area, with its unique set of job, economic and demographic factors, appears to be positioned for another positive year.

Overall, real estate should continue to be strong in 2006, but returning to more normal market conditions, which should benefit Buyers.

Tuesday, March 14, 2006

Zillow.com: All the science of pricing ... but little of the art

I wondered how accurate these estimates (or "Zestimates") could be. I did a quick test using my current DC address. No luck. When I clicked further on my search results, I got the following message, "County transactional data for this home is insufficient so we cannot calculate a Zestimate." I tried another few DC addresses. Turns out, Zillow doesn't have data on recent sales for any addresses in DC.

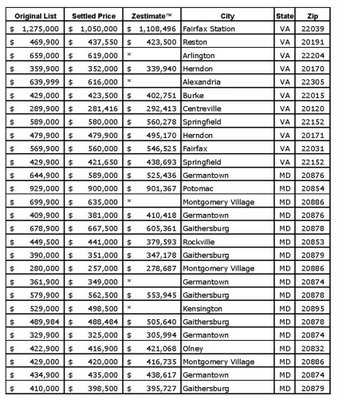

If you live in DC, Zillow is useless.

I then did a few random searches for properties in Maryland and Virginia and had better luck. But I wanted to try a more scientific approach at ascertaining the accuracy of the data that Zillow was spitting out, so I did a quick search in the MLS for any property in Montgomery County, Arlington County, Alexandria City, and Fairfax County that had settled in the last 48 hours. I then compared the original list price, the final sales price (less any seller contribution), and the Zestimate that Zillow produced for the same addresses. The results are in the chart below (click on the chart for a more readable version):

You'll see that in some instances, Zillow was uncannily accurate. In others, it was way off base. Additionally, in some cases (noted in the chart above by an asterisk in the Zestimate column), Zillow either couldn't locate the property, or couldn't produce a Zestimate at all.

My sense is that in newer neighborhoods where many of the homes were constructed at around the same time and are of similar size, style, and amenities, Zillow will be able to produce a Zestimate that is in line with the actual sales price a seller could expect to realize. Likewise, in neighborhoods where properties were built at different times and have different styles and features (or have been updated at different times), Zillow will have a more difficult time producing an accurate Zestimate.

But guess what. Those issues are the exact same issues that actual human real estate agents must contend with. However, a good real estate agent will have the benefit of being able to see the other listings on the market, know the local pricing customs and strategies, and understand the mindset of the prospective buyers for a particular property.

In the end, any property is worth ONLY what a real, flesh-and-blood purchaser is willing to pay. Period. My advice: if you are looking to buy or sell a house, you may want to try Zillow for fun, but don't necessarily bank on the estimates it provides.

Meanwhile, REALTORS should be prepared to respond to valuation questions from buyers and sellers who have first been to the Zillow site and have their own idea of a property's worth. REALTORS may find themselves in the position, for example, of having to explain why Zillow's valuation missed the mark.

Good REALTORS should have no problem with that.

Montgomery County Predatory Lending Law Suspended

Thursday, March 09, 2006

Feeling Nosy about DC? VA? MD?

- Feeling nosy about the District of Columbia?

- Feeling nosy about Virginia?

- Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!)

Tuesday, March 07, 2006

You can appeal your increased property tax assessment

Maryland assessment notices go out to one-third of all property owners, on December 30. Those owners have until Feb. 14 to appeal with the local tax assessor's office. If the local office determines the assessment was in error, the homeowner will get a revised assessment about a month later. Homeowners then get 30 days to appeal the revised assessment to county property tax appeals boards, made up of three local residents and an alternate appointed by the governor for five-year terms. Those who are still not satisfied have another month to appeal to the Maryland Tax Court.

In Virginia, homeowners can appeal to either the local assessment office or the local Board of Equalization, groups appointed by officials in each county. The boards generally have later deadlines for appeals than the local assessors. If not satisfied, the homeowner can go to the Circuit Court.

In the District, homeowners appeal first to the assessor assigned to the property. If the assessor's decision does not satisfy the owner, he or she has 30 days from the date of notice of final determination from the first level to appeal to the Board of Real Property Assessment and Appeals. A property owner can then appeal to the District's Superior Court.

Below you'll find instructions on how to appeal a property tax assessment:

If your property's been on the market 90 days, you're gonna get low offers.

Help me out here.

Your property is on the market almost three months, and you're DISGUSTED by the FIRST offer you receive? Huh? OK, so it wasn't a full-price offer. It was an offer ... your FIRST offer in three months. C'mon. A buyer takes the time (three or four hours, minimum) to get preapproved for a loan, preview your property (twice), and craft and submit an offer in good faith. Make a counteroffer, for cryin' out loud. If it's not gonna work, it's not gonna work ... but at least you'll have closed the loop in a courteous, professional way.

Perhaps another three months will bring this seller in line with reality. Perhaps.

Do you own a rental unit in Maryland? Read on...

Thursday, March 02, 2006

Feeling Nosy about DC? VA? MD?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!)

Thursday, February 23, 2006

Feeling Nosy about DC? VA? MD?

Ok, I know you're probably not planning on moving this very second, but here's this week's list of interesting-looking listings that have just come on the market. Mind you, they may not actually be my personal listings --- just intriguing properties I've come across that week.

- Feeling nosy about the District of Columbia?

- Feeling nosy about Virginia?

- Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!)

Wednesday, February 22, 2006

Witnessed by local REALTORS this week

- “We listed a multi-unit in Brookland Feb 1 for $529K --- received 4 offers yesterday --- went for $539K.”

- “Had a buyer looking at houses in Capitol Hill. Found a sturdy row house that needed a lot of work, listed at $499K that had been on the market 7 days. Competed against an investor who wanted to convert house into two condo units. My buyer won at $518K.”

- “We listed a charming row house in Mount Pleasant at $659K. It sold in 4 days slightly over asking price with only one offer … but lots of visible interest.”

- “Multiple-offer situation in Mount Pleasant for a house listed at $550K. House needed work. Five offers, ultimately went for around $610K, my buyer lost.”

- “My buyer was involved in a multiple-offer situation in Mount Pleasant for a house listed at over $1M. There were two offers on the table, and my buyers won at asking price.”

- “My buyer’s offer was one of four on a $699K listing in Chevy Chase (DC). Our offer was clean (no appraisal or inspection) and escalated to 7% above asking price. My clients were thrilled to get the property for 4% (+/-) above asking price.”

- “Fabulous condo in Kalorama. I saw it the first day it was on the market. Listed between $1M and $1.5M. I showed my clients the next morning with a blank contract in hand. Wrote an offer at the property: Full price; no appraisal; no financing contingency; but with an inspection. Seller ratified right away. Three buyers waited to see if our offer would fall through. It might have gone above list if given another day's market exposure. Lucky for us.”

Thursday, February 16, 2006

Feeling Nosy about DC? VA? MD?

Ok, I know you're probably not planning on moving this very second, but here's this week's list of interesting-looking listings that have just come on the market. Mind you, they may not actually be my personal listings --- just intriguing properties I've come across that week.

- Feeling nosy about the District of Columbia?

- Feeling nosy about Virginia?

- Feeling nosy about Maryland?

If you know someone who might be interested in this list, please forward it on to him or her. And if there's a listing that you're curious about yourself, just let me know ... and I'll show it to you ... just for the hell of it ... no obligation ... *I promise*. Really. (One of the perks of being the friend of a real estate agent ought to be that you get to freely snoop around other peoples' homes!)